Our study advice is based on a well-thought plan of education which relies on our extensive experience as a provider of learning services. Nevertheless, the advice concerns a recommendation, certainly not a must. Our study advice is as follows:

Regulatory Requirements, Operational Necessities & Functional Desires

Any target group faces its own specific learning objectives. These goals may be driven by a functional desire, an operational necessity or regulatory requirements. Some education is nice to have, other education concerns a must have. The latter may be operationally driven or be enforced by the compliancy framework.

- Functional desires

- To be more efficient & effective

- To understand better and being able to relate to each other

- To improve communication

- To increase joy & pleasure at work

- Operational necessity

- Without this kind of knowledge one cannot perform one’s tasks properly

- Without this kind of knowledge one cannot practically apply what one has learnt

- Regulatory requirement

- Obligatory training

- Mandatory by legal enforcement

In more detail, this lead to the following:

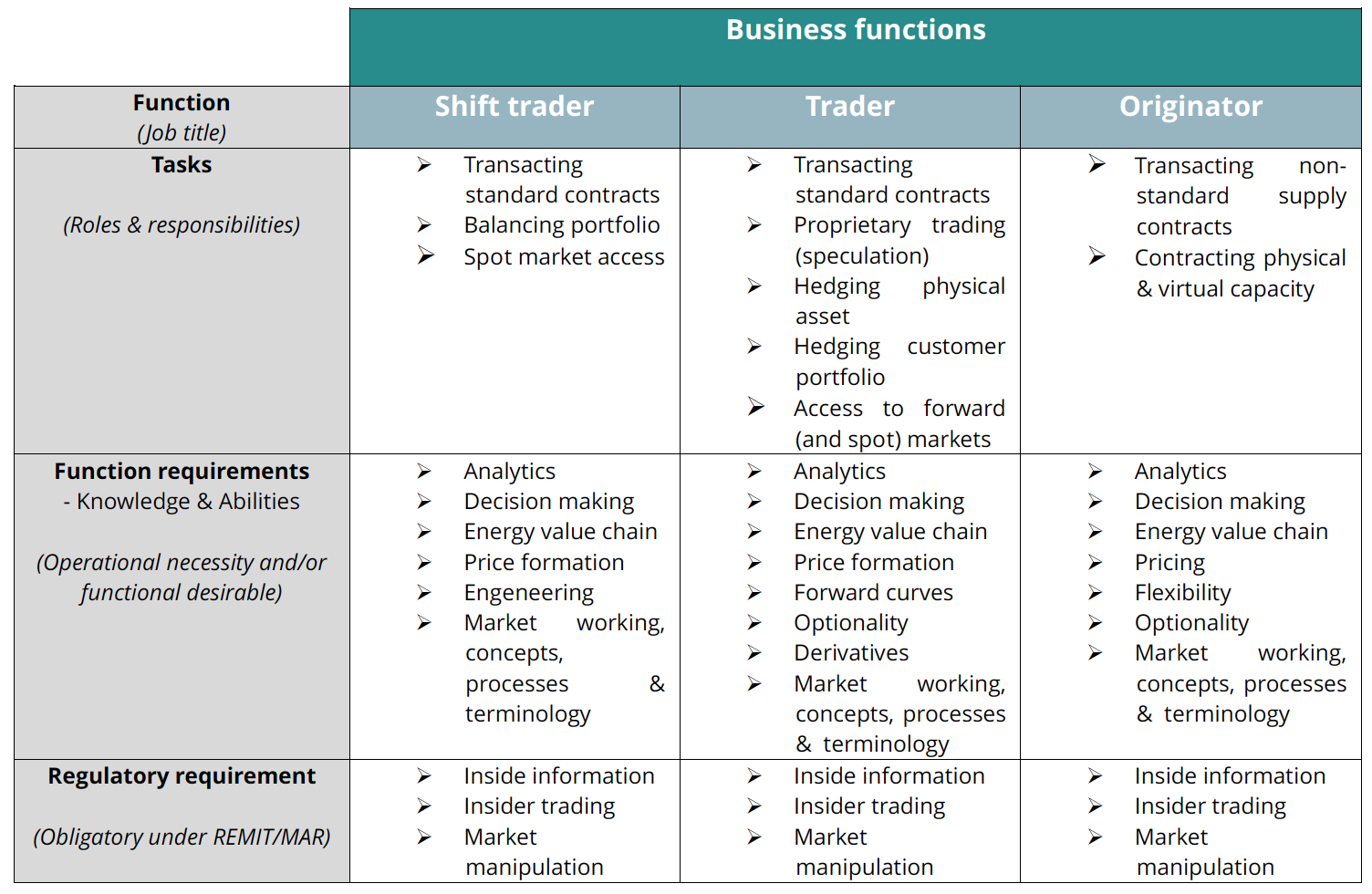

A. Functions with market access:

- Business functions

Professionals with market access could possibly trade based on inside information or manipulate a market. Companies must be shielded against sanctions and harming of its reputation. Individuals must be aware of what is allowed and what is not. They should know how to interpret practical situations, on a case-by-case basis. This requires significant and specific skills, especially since the devil is in the detail.

B. Functions without market access:

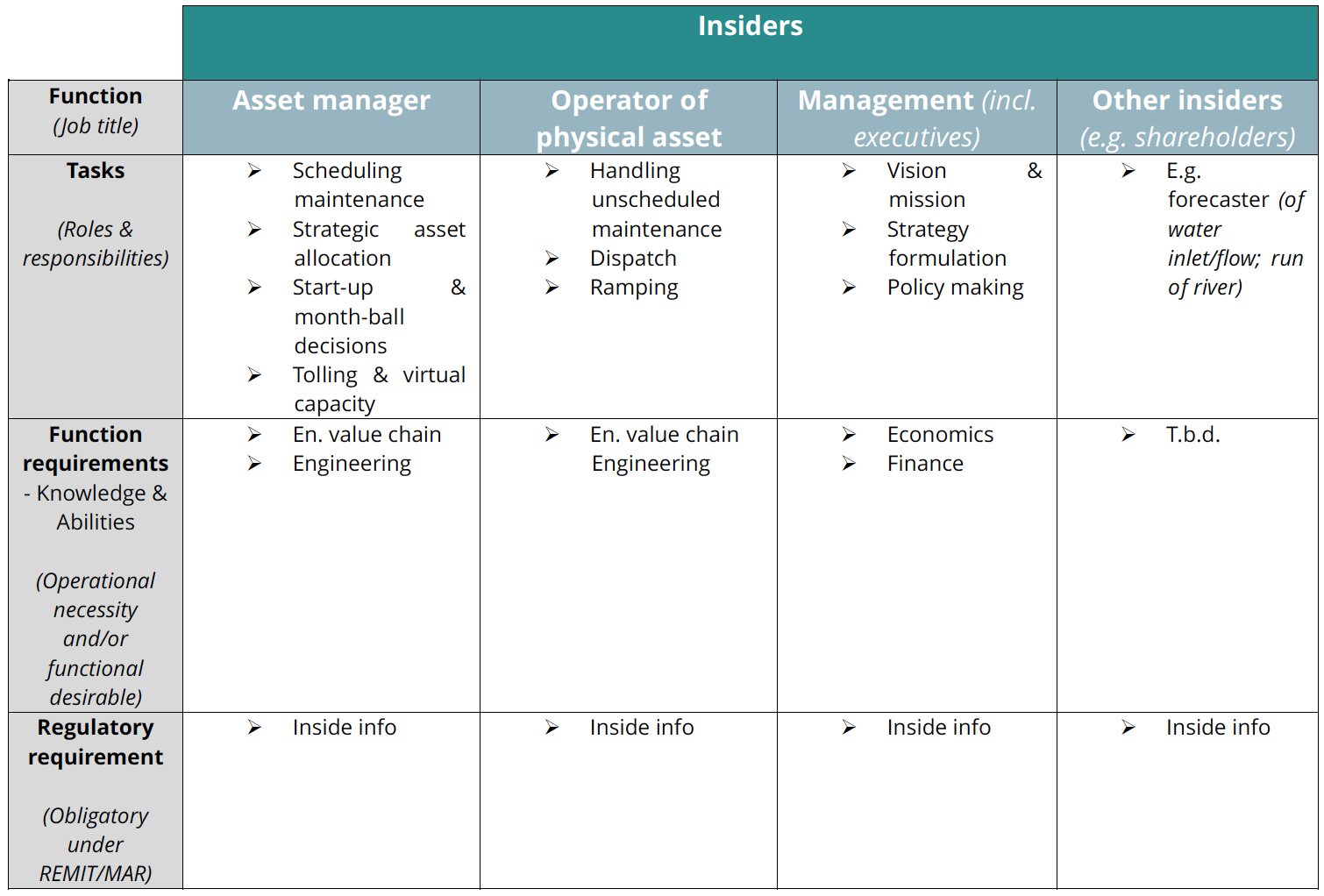

i. Insiders

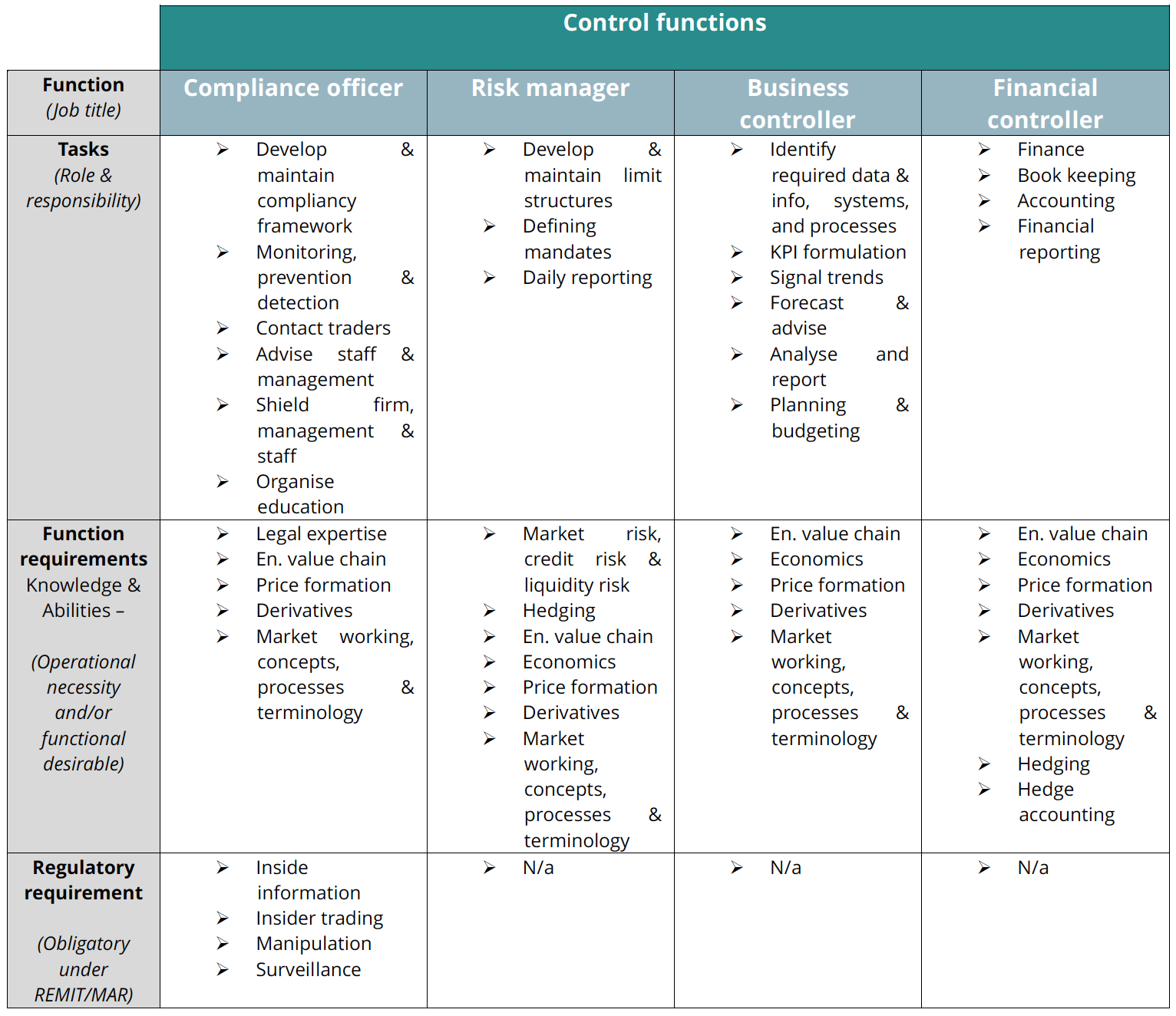

ii. Control functions

iii. Support functions

i. Insiders:

All organisations in scope of REMIT should create awareness with their insiders in the field of REMIT and/or MAR in general, and specifically about inside information, and the related obligation to publish. It must be noted that shareholders and executives are also considered insiders.

Inside information is not allowed to be disclosed unlawfully, not is it allowed to trade on its basis. This is why insiders must know about this. They must be able to identify when information can be classified as inside information, and how this kind of information must be treated.

ii. Control functions:

Professionals in control functions have to monitor processes and activities, as well as develop procedures and protocols and maintain or update these. In case of a compliance function this requires knowledge of regulations, but also of the business. That is why training should not be limited to regulation only. It is a necessity to master knowledge about the value chain and markets, products, pricing and trading.

Under MAR a trading firm (i.e. compliance function) has to monitor the activities of its own traders. Suspicious activity must be reported to authorities. In order to interpret practical cases, they must be knowledgeable and skilled. Not just in the field of regulation, but also concerning the physical value chain and markets, products, pricing and trading.

iii. Staff with support functions:

As stated by ACER guidance on REMIT: Training on REMIT should not be restricted to the members of the market surveillance team and should be offered across the organisation where appropriate. Supporting staff with energy trading firms are amongst such. This may include Back office staff, IT experts and even HR.

As an example, settlements officers in the back office departments of energy firms, have to handle indexed contracts, whereby invoicing is based on a benchmark or reference price (e.g. index). However, indices can be manipulated. Therefore, for settlements officers it is important to know the specifics of index calculation procedures, as well as how the regulation relates to this.

Another example at the back office may concern a confirmation officer who notices a suspicious transaction.

IT experts at the information technology department, or the data management desk may concern the next example. They may be involved with publishing inside information (or creating the right formats for it), as well as assuring a proper operation when it comes down to data reporting.

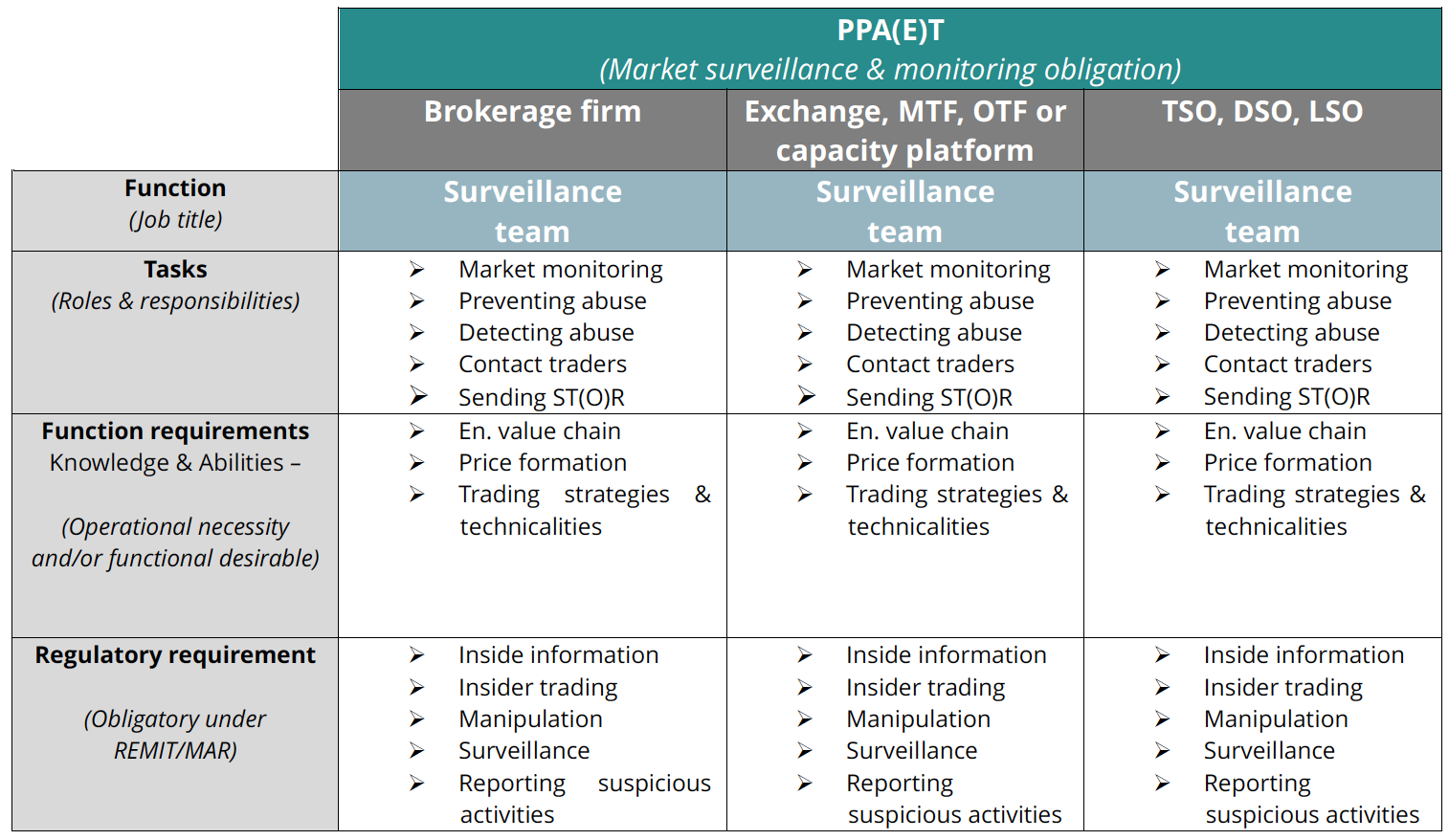

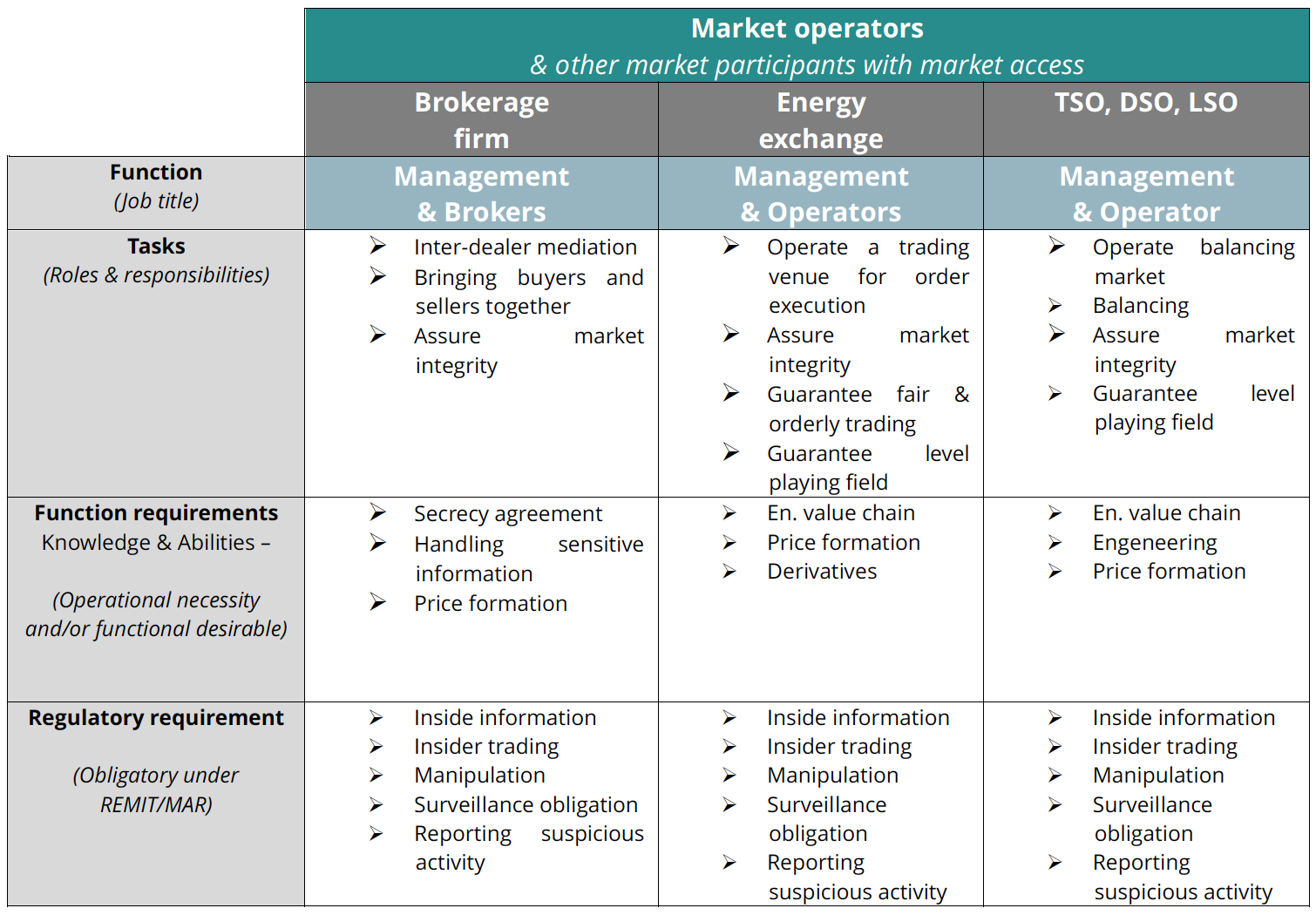

C. Other market participants & market operators:

- Market parties with market access, or market operator (e.g. trading platform)

- Brokerage firm

- Trading venue (i.e. Regulated market, MTF, OTF & auction platform)

- TSO

- As PPA(E)T

- Brokerage firm

- Exchange and auction platform, or any other trading facility

- TSO

Operator of OMP/trading venue & market participants

A professional with market access could possibly trade based on inside information or manipulate a market.Companies must be shielded against sanctions and harming of its reputation. Individuals must be aware of what is allowed and what is not. They should know how to interpret practical situations, on a case-by-case basis. This requires skills, especially since the devil is in the detail.

PPA(E)Ts have to monitor the activities that take place. They have to report suspicious activity. In order to interpret practical cases, they must be knowledgeable and skilled. Not just in the field of regulation, but also concerning the physical value chain and markets, products, pricing and trading.